Tabarak Paracha

February 20, 2025

In this post, we delve into the latest data, trends, and insights that showcase the state of mobile gaming in Brazil in 2025.

Drawing from exclusive industry reports, and insights from a leading local expert, we’ll explore the factors driving this remarkable growth, and the unique characteristics of the Brazilian gaming market.

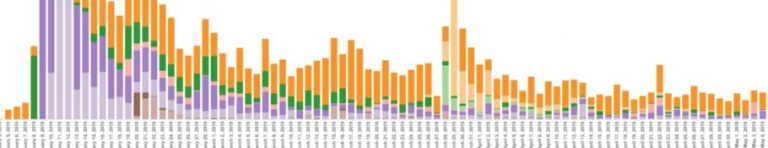

The State of Brazil’s Mobile Gaming Market

Data source: Abragames & Nordicity, “The Golden Opportunity: A Whitepaper on Brazil’s Games Industry,” November 2024. Link to the report

Brazil’s gaming industry has been on a remarkable trajectory, with the country emerging as the fifth-largest gaming market in the world in terms of online population, with an estimated 103 million online gamers—a figure that underscores the immense potential of this market.

Data source: Abragames & Nordicity, “The Golden Opportunity: A Whitepaper on Brazil’s Games Industry,” November 2024. Link to the report

When it comes to the mobile gaming landscape, Statista reports that the mobile platform market share in Brazil is dominated by Android, accounting for 83% of the market, while iOS holds a 17% share.

Source: Statista, “Market share held by mobile operating systems in Brazil,” Link

This Android-centric mobile gaming ecosystem presents a unique opportunity for game developers and publishers.

Monetization Trends: Thriving Ad Revenues and In-App Purchases

We used Tenjin’s 2024 data set to put together some additional stats on Brazil in terms of specific metrics like ad spend, ad revenue and in-app purchases (IAPs).

Here is what we found:

- On Android, Brazil ranks 3rd globally in terms of ad spend, while on iOS, it holds the 12th position.

Source: Tenjin’s 2024 data set - In terms of ad revenue, Brazil is the 4th largest market on Android and the 11th largest on iOS.

Source: Tenjin’s 2024 data set - And finally, in terms of top countries by in-app purchases (IAPs), Brazil holds 5th place on Android and 10th place on iOS.

Source: Tenjin’s 2024 data set

These figures underscore the willingness of Brazilian gamers to engage with both in-app advertisements (IAA), as well as in-app purchases (IAP’s)—both crucial revenue streams for mobile game publishers. Further it is interesting to observe that despite the economic turbulence in Brazil, people are still okay with spending on in-app purchases (IAPs).

The Mobile Game Development Industry in Brazil

According to the data, the gaming industry in Brazil has experienced a tenfold growth in the past decade, with the number of game developers reaching an impressive 1,042 by 2023.

Data source: Abragames & Nordicity, “The Golden Opportunity: A Whitepaper on Brazil’s Games Industry,” November 2024. Link to the report

According to Everton Vieira, Mobile is closer to 25% of the studios’ focus, and the rest are split between PC, consoles, and even web.

Interestingly, the data also reveals that a significant portion of the gaming industry in Brazil is focused on outsourcing. Vieira explains that this trend is a result of the industry’s maturity, where more experienced studios are better equipped to handle outsourcing tasks compared to designing and developing their own products.

However, Vieira also anticipates a shift towards more product-driven development in the coming years, as the industry continues to mature and local studios gain the necessary expertise and resources to create their own original games.

According to the data, the industry generated $251 million in revenue in 2022.

Vieira acknowledges that the industry has felt the impact of the recent crises, with some studios unfortunately having to close their doors and layoffs occurring. However, he remains optimistic about the industry’s future, stating, “I can say that [revenue] keeps growing year over year.”

The key to this continued growth, according to Vieira, lies in the evolution of monetization strategies, particularly the shift towards free-to-play models and in-app purchases. He believes that as Brazilian gamers become more comfortable with these monetization approaches, the industry will see a corresponding increase in revenue.