Tabarak Paracha

April 7, 2025

Overview

Pakistan’s mobile gaming industry is experiencing unprecedented growth, driven by increasing smartphone penetration, affordable internet access, and a rising pool of talented mobile game developers. According to a recent report, the number of gamers in Pakistan is expected to reach 50.9 million by 2026, contributing to a thriving gaming community and an industry projected to generate over $8 million in revenue, driven by a rapidly growing player base (Bloom Pakistan, 2025). As global interest in emerging gaming markets continues to rise, Pakistan is positioning itself as a key player in the South Asian gaming ecosystem.

This report provides an in-depth look at the state of mobile gaming in Pakistan in 2025, combining insights from 50 Pakistani mobile game studios with industry data on top-performing mobile games, and publishers in 2024, sourced from AppMagic. By analyzing trends in mobile game development, monetization strategies, and user acquisition, we aim to highlight the opportunities and challenges shaping the industry.

We begin with insights from 50 mobile publishers collected through a survey in 2025, followed by AppMagic’s 2024 data on Pakistani mobile games and publishers. Finally, we will close with predictions and advice from top industry experts in Pakistan.

About Tenjin

Tenjin empowers growing mobile publishers to scale with simple but effective advertising measurement tools. Starting at $200/month, users access all features with no hidden costs. Trusted by over 30,000 apps and partners like Meta, Google and Applovin, Tenjin has been driving success since 2014 after graduating from the Y Combinator accelerator program.

Executive Summary

Survey

AppMagic

Part 1: 2025 Survey Insights

Business Overview

Breakdown of Pakistani Mobile Gaming Studios by Size (2025)

– 40% of respondents had a company size of 1-10 employees

– 32% of respondents had a company size of 50+ employees

– 28% of respondents had a company size of 11-50 employees

Breakdown of Pakistani Mobile Gaming Studios by Years of Operation (2025)

– 36% of respondents had been in operation since 1-3 years and 5 years respectively

– 18% of respondents had been in operation since 3-5 years

– 10% had been in operation since less than 1 year

Breakdown of Pakistani Mobile Gaming Studios by Primary Genre (2025) – Multiple Responses Allowed

– 80% of the respondents primarily focused on simulation games

– 52% of the respondents primarily focused on casual games

– 48% of the respondents primarily focused on hyper-casual games

– 28% of the respondents primarily focused on mid-core games

– 26% of the respondents primarily focused on other genres of games

Ad Monetization

Breakdown of Pakistani Mobile Gaming Studios by Average Monthly Revenue (2025)

– 40% of respondents had a monthly revenue per game below $1,000

– 40% of respondents had a monthly revenue per game between $1,000 – $10,000

– 12% of respondents had a monthly revenue per game between $10,000 – $50,000

– 8% of respondents had a monthly revenue per game of $50,000+

Breakdown of Pakistani Mobile Gaming Studios by Revenue Model Distribution (2025)

– 66% of respondents monetized their games through both IAA (in-app ads) and IAP (in-app purchases)

– 30% of respondents monetized their games through only IAA

– 4% of respondents monetized their games through only IAP

User Acquisition

Breakdown of Pakistani Mobile Gaming Studios by Primary Marketing KPI Focus (2025)

– 64% of respondents said ROAS (return on ad spend) was their main marketing KPI

– 14% of respondents said CPI (cost-per install) was their main marketing KPI

– 14% of respondents said Time To Profitability was their main marketing KPI

– 8% of respondents said LTV (lifetime value) was their main marketing KPI

Breakdown of Pakistani Mobile Gaming Studios by Biggest UA Challenge (2025)

– 27% of respondents said high CPI was their biggest UA challenge

– 25% of respondents said low retention was their biggest UA challenge

– 22% of respondents said budget constraints was their biggest UA challenge

– 21% of respondents said lack of experience was their biggest UA challenge

– 5% of respondents said not knowing which MMP to choose was their biggest UA challenge

Breakdown of Pakistani Mobile Gaming Studios by Target Regions for User Acquisition (2025)

– 82% of respondents run UA campaigns globally

– 16% of respondents target only established markets for UA

– 2% of respondents target only emerging markets for UA

Breakdown of Pakistani Mobile Gaming Studios by most used User Acquisition Channels (2025) – Multiple Answers Possible

– 41% of respondents used Google Ads as their UA channel

– 20% of respondents used Mintegral as their UA channel

– 10% of respondents used Applovin as their UA channel

– 10% of respondents used Unity Ads as their UA channel

– 9.5% of respondents used other UA channels

– 6% of respondents relied only on Organic Growth to acquire users

– 3.5% of respondents used Meta as their UA channel

Breakdown of Pakistani Mobile Gaming Studios by User Acquisition Team Size (2025)

– 38% of respondents had one person working full time in their UA team

– 24% of respondents had 2-5 people working full time in their UA team

– 20% of respondents had one person working half time in their UA team

– 10% of respondents had more than 10 people working full time in their UA team

– 8% of respondents had 5-10 people working full time in their UA team

Breakdown of Pakistani Mobile Gaming Studios by Annual Paid Downloads (2025)

– 38% of respondents get less than 240K paid downloads annually

– 22% of respondents get between 600K and 5M paid downloads annually

– 18% of respondents get 12M+ paid downloads annually

– 14% of respondents get between 240K and 600K paid downloads annually

– 8% of respondents get between 5M and 12M paid downloads annually

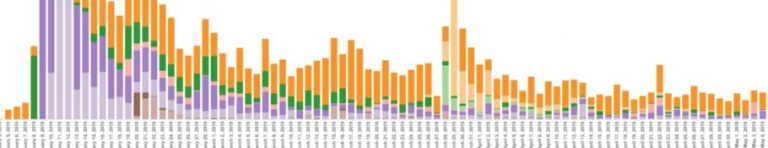

Part 2: AppMagic Insights for 2024

Top 10 Mobile Publishers in Pakistan in 2024 by Games Revenue

*Disclaimer: Revenue numbers only include in-app purchases (IAPs) and not in-app ads (IAA)

Top 10 Mobile Publishers in Pakistan in 2024 by Downloads

*Disclaimer: Downloads numbers include both organic and paid downloads

Top 10 Mobile Games by Pakistani Studios in 2024 by Games Revenue

*Disclaimer: Revenue numbers only include in-app purchases (IAPs) and not in-app ads (IAA)

Top 10 Mobile Games by Pakistani Studios in 2024 by Downloads

*Disclaimer: Downloads numbers include both organic and paid downloads

Part 3: Predictions & Advice from Industry Experts

Methodology

This report on The State of Mobile Gaming in Pakistan in 2025 is based on a combination of survey data, market intelligence, and expert insights. The methodology for each section is outlined below:

Part 1: 2025 Survey Insights

Between January and February 2025, we conducted a survey of 50 mobile gaming studios headquartered in Pakistan. The survey focused on key business areas, including company structure, user acquisition strategies, and ad monetization practices. Responses were collected through an online questionnaire and supplemented with follow-up discussions where necessary. The aggregated insights are presented in graphical format throughout the report.

Part 2: AppMagic Insights for 2024

For historical market trends, we collaborated with AppMagic, a leading mobile market intelligence platform, to analyze the top-performing mobile games, and publishers in Pakistan in 2024. This data offers a retrospective view of the industry, highlighting key players and trends that shaped the market leading into 2025.

Part 3: Expert Predictions for 2025

To provide forward-looking insights, we gathered predictions and strategic advice from top industry experts within Pakistan’s mobile gaming ecosystem. These experts shared their views on anticipated trends, challenges, and opportunities for the industry in 2025. Their insights serve as valuable guidance for developers, publishers, and investors navigating the evolving landscape.