Tabarak Paracha

November 26, 2024

In the ever-evolving world of mobile gaming, understanding the dynamics of ad revenue is crucial for developers and publishers looking to maximize their monetization strategies. We sat down with Google’s Mariusz Gąsiewski to discuss some of the latest data points on gaming revenue. Believe it or not, the potential for ad revenue looks pretty bright.

Watch the full video to learn why.

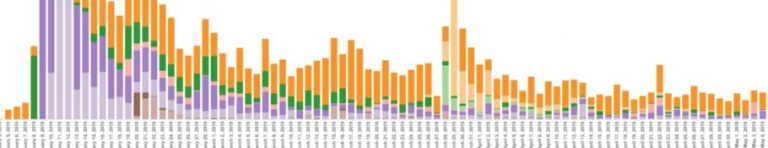

IAA vs IAP share by genre

One of the key insights Mariusz shared was the varying distribution of ad revenue across different game genres. By analyzing data from various industry sources, he was able to paint a comprehensive picture of how ad revenue is allocated within the mobile gaming ecosystem.

Mariusz explained that certain genres, such as board games, solitaire, and word games, tend to have a higher share of ad revenue compared to their in-app purchase (IAP) revenue. This is because these genres often cater to a wider audience, where even a small amount of revenue per user can add up significantly due to the massive scale of the user base.

On the other hand, genres like action RPGs, strategy games, and match-3 titles typically have a lower share of ad revenue, as they are more focused on monetizing their core, high-value users through IAPs. In these cases, developers are often hesitant to risk losing their whales by heavily relying on ads, which could potentially disrupt the user experience.

What Ad Formats to use?

Mariusz also delved into the intricacies of different ad revenue formats and their impact on overall monetization. He highlighted the importance of rewarded ads, which he likened to a “low-value in-app purchase” in the sense that they are user-initiated and often provide a seamless experience to the player.

In genres where IAP revenue is the primary focus, rewarded ads tend to make up a significant portion of the ad revenue pie. This is because they are less disruptive to the core gameplay loop and can be strategically integrated to provide value to both the player and the developer.

On the other hand, in more casual or hyper-casual games, where user retention tends to be shorter, developers may opt for a more diverse ad revenue mix, including interstitial ads that can be served to a wider audience more frequently. This approach allows them to quickly monetize a larger portion of their user base, even if the individual ad revenue per user is lower.

User Acquisition for IAA and IAP games

Mariusz also shared insights into the shifting trends in user acquisition (UA) strategies, which have a direct impact on ad revenue dynamics. He highlighted the growing importance of value-based UA campaigns, where developers focus on acquiring users who are more likely to become high-value spenders or engage with ads.

This shift away from pure cost-per-install (CPI) campaigns has led to a more diverse ad revenue landscape, as the influx of users from non-gaming verticals, such as retail and consumer packaged goods (CPG), has introduced new revenue streams that are less prone to cannibalization between in-app purchases and ads.

Mariusz explained that the increased participation of these non-gaming advertisers has created a more balanced ecosystem, where developers can potentially monetize their users through both IAPs and ads without the risk of directly competing for the same revenue sources.

Predictions for IAA and IAP

Looking ahead to 2025, Mariusz shared three key predictions that shed light on the future of ad revenue in mobile gaming:

- Continued Growth: Mariusz believes that the overall ad revenue in the mobile gaming industry will continue to grow, potentially outpacing the growth of in-app purchase revenue. This is driven by the increasing sophistication of ad monetization strategies and the continued expansion of non-gaming advertisers into the mobile gaming ecosystem.

- Increased Focus on Monetization: As the competition in the mobile gaming market intensifies, developers and publishers will place a greater emphasis on optimizing their monetization strategies, exploring hybrid models that combine IAPs and ads, and leveraging new tools and technologies to enhance their ad revenue streams.

- Emerging Market Opportunities: Mariusz anticipates that the growth in ad revenue will be more pronounced in emerging markets, as these regions often have a more favorable economic outlook compared to their Western counterparts. This shift could lead to developers and publishers reevaluating their geographic focus and adapting their monetization strategies to capitalize on these emerging opportunities.

Transcript

Roman: Hey everyone, this is Roman from Tenjin. Welcome to another episode of Tenjin ROI 101. Today we have a special guest, Mariusz from Google. Mariusz, a few words about yourself.

Mariusz: Hello, my name is Mariusz. I work for Google quite a long time already. I work with top clients of Google in the Central Eastern Europe from different verticals but on the other side, I work a lot of with the data.

So I spent quite a lot of data to understand users behavior, especially in the gaming and iGaming as well, and some non gaming categories. That’s why actually I’m happy to share some insights with you as well.

Roman: Yeah. If you don’t fall. for Mariusz on LinkedIn. It’s a big mistake. He’s always posting a lot of data.

You’ll see today. This is our topic. Like Trends for 2025, Hot Genres, State of Mobile Gaming 2024. This is an episode where you’ll see all of the graphs. What’s growing, what’s not growing, and all of the cool stuff. Let’s start then, Mariusz. My first question. Actually, this is based on one of your LinkedIn posts.

You posted, and we’ll share now, the slides, but you posted, like, how much every venue, each game genre. And I just want to look at this graph with you and maybe we can comment and discuss what should we expect next?

Mariusz: Sure. Yes. So of course it’s very hard to exercise trying to understand what is the share of the arts in the different categories.

So how I did it, it was like, there is some available data unity is sharing a really good reports, but then actually I discussed it with quite a few people in the industry. That’s actually no good. point that over the those LinkedIn discussions, I have quite not good networking that space as I was able to validate that data.

With quite a few people. So that’s actually when a lot of people were asking me how actually it is in terms of the share of us revenue, total revenue. Because if we look at the data that’s available on the market, there is much more data around the in app revenue and subscriptions because there is like no amazing data that is provided by sensor tower data up magic.

But there is much less data around the odds revenue. Because, of course, on one side it’s much harder to measure it, on the other side concentration of the revenue is much smaller if you compare it with in app revenue. Top games in the ads revenue they have much lower share of the revenue than In then in the app.

So that’s why but I approached it and trying to look at like comparing this data and it is quite visible that, of course, if we look at the data, there are some genres like board games, solitaire world games were actually that share of the arts revenue. It’s actually very high.

Because usually those genres are focused on a very wide audience. You, if you have checkers game or like chess game very often you have millions of users, like in trivia or like in very casual games. So that’s why you are trying to monetize, even not very high monetization, but the widest possible audience.

Yeah so that’s why in overall. Even if you get a few cents per each user by this scale, it’s actually getting getting much, much bigger. But of course, if we look at other genres for example, here we have more more data runs, more like the core genres. Where in general most of the revenue even in apps is coming from small percentage of the users And even in user acquisition we have mostly value campaigns.

It doesn’t matter if it’s google meta or or like any other like the traffic provider you are just trying to bring more whales then of course, by definition you don’t want to like risk losing all of them by sharing giving them way to go away from the from the game.

So that’s, in those types of games, usually share of the ads revenue is pretty, pretty low. So that’s why I think one dimension, which is what is the share of the ads revenue, total revenue? The other one that is, that I think is even less discussed and less analyzed, actually, what is even happening inside that ad revenue.

Because on one side we see what is the share of the ad revenue, but what is quite interesting to look at is that, but what are actually different formats inside that ad revenue. What I mean by that is, for example, if we look at the at the genres, like we have let’s see, match tree or action RPG or 4X strategy.

that have pretty, pretty small percentage of the revenue, then almost all revenue in in in, in that’s ad revenues taken by high eCPM types of the ads. Yes, almost all revenues taken by rewarded. Because by the by the definition the reward that is very close to in app. Yeah, so it’s not pushing that not push towards all users.

It’s initiated by the user. Yeah, so we can say that reward that is actually the low value in app in some way. So that’s why if we have some like strategy games, hybrid match tree games, or like in general, those types of games that focus on higher value users, then any experience with us, those like developers having those games, they’re usually starting from rewarded.

But on the other side, if you have some games like, solitaire, war games, or even hyper casual, where usually the There is specific retention that is very high at the beginning, but goes down very fast because those are not the types of the games that people play for years.

You rather play them for weeks. Then, of course, even if you have white audience, you try to monetize them quickly. So that’s why quite substantial part of the revenue, for example, is taken by the ads where you can monetize the highest. possible ratio of users, like interstitial, yeah? So that’s why, for example, in those ads, in those, sorry, those types of games we have much more, even those more invasive, but wider set of the the ads that can actually allow you to monetize in pretty quick time wider ratio of users.

Roman: Got it. And this actually gives me an answer or another question, because I also hear this a lot I want to do hybrid game. How much of AdreVenue should I have versus EAP, right?

Mariusz: If we look at that data, that I in some ways average data, but of course it’s skewed towards more like the bigger games.

Because even if I had mostly with the people who have bigger games, which means that by definition, those games the ratio of the in app revenue to arts is higher. So that’s why, for example, if I’m sharing some data around, let’s see much tree by definition, if someone has small much three games, probably his share of the arts revenue will be higher because again, the revenue concentration in apps is in the subscriptions very high in in top games.

So that’s one important point to to remember. So again, if you have bigger game, probably your data can be a little bit corresponding more towards the data. If you have smaller, probably the you can expect higher share of the other revenue versus what in that data. So that’s one important point.

The second one is of course what is your idea for increasing of that monetization. So from what I see is that if you start to do testing around hybrid monetization, usually the first idea is, okay, if I have some significant percentage of users who are not monetizing in the games at all.

Because let’s see in the games, even like two percentage conversion rate is pretty, it’s really good result, for example, and many games have much lower. So you have significant percentage of the users who monetizing at all. Then probably the first question starts, how actually I can monetize even in minimum level, the highest possible ratio of users.

So it’s, which means in, from the operational perspective, how I can create maybe even one reward that placement that can be used by highest. possible ratio of users. So it’s not my goal to, to focus to push five rewarded users five rewarded ads per user, but how to make sure that even highest possible ratio of users.

Can get unrewarded. Why? Because of course, always in this ad monetization, the first watch of the ad will have much higher ECPM than the second one or the third one. Yeah. So finally, if you are able to push that even pretty low intensity ads revenue towards the highest possible ratio of users, then finally the outcome will be better for your business.

So that’s, I think, second second important point. And the third one is, of course, how to avoid cannibalization which I think is getting a little bit easier, because if we look at the data, and I was actually sharing that some time ago. Let me go to that. So this is actually quite interesting data.

Because it’s showing how actually share of the mobile ad spend is changing in the industry. So here we have comparison of two data points, 2019 versus 2024. And we see the, what is the mobile ad spend. From the user acquisition perspective, so which types of verticals are spending most of the money on in apps overall then we see that actually there is quite substantial growth of the verticals like retail and CPG.

And why is it so important? It’s actually extremely important because it shows that we see growth of the revenue coming from those types of businesses that are not by definition creating cannibalization in the hybrid monetization because, for example, if most of your ads are coming, most of your ads in your game are coming from another game And then finally, the effective eCPM is defined by mediation.

Then mediation is trying to understand what is the value of user based on his probability to purchase. So in this case, if you have either you monetize someone, By in app or you monetize him by in app by ads that is estimated by based on his probability to to buy something, then this hybrid monetization in reality is really moving money from one pocket to another one.

Yeah. But if you have more money coming from businesses like, retail travel CPG, for example, then, what is CPG, Mariusz?

Roman: Sorry, you mentioned it second time. I don’t know what does it mean. What is CPG?

Mariusz: So like fast moving businesses so in general, like those Unilever Procter Gamble, like those types of businesses, so food beauty, like those, that, those, that in general, by definition, they spend more money in probably something that we can call performance branding but they really care about mobile and especially games because how they spend money in the previous years.

So far they’re spending most of the money in TV and in general, those channels that users are actually interacting for a pretty long time with. So they are like buying the ball, the eyeballs, because the people finally they buy the products in the shops when they remember. Okay.

I remember that. Really good diapers coming from pumpers, for example, so in this case, because if we know that in games, people spent extremely high amount of time, so there is even data showing that if we compare the share of time spent By users versus share of the mobile ad spent. So how much money it’s spent on the, on, on those users in the like marketing industry that the ratio is one one to two.

So people spend two times more time than actually money that is spent on them. So from that perspective, of course. Games are extremely lucrative part of the business for those types of businesses, because in general you can reach those users at much minor kind of, maybe not cheaper, but more effective way comparing to other channels, which again creates the case when.

You have the odds from the businesses that not necessarily care,

About that just your probability to buy something in the game. Yeah. So I’m giving often like example of my wife who on one side, she’s playing a lot of the games, but she never bought anything in the games. But on the other side, from the demographics perspective, she’s extremely valuable and important person for many like for example, CPG brands.

I see.

Roman: Okay. Do you think probably a noob question, but if I’m a developer Like, can I really have a control over this? What type of ads are shown, CPG or retail, and can I ban any game related?

Mariusz: So usually you have the ability to exclude specific advertisers, like specific let’s call it potential advertisers.

I don’t see that still happening quite often. I Maybe including like those types of businesses where you have extremely extremely close competition, yeah? It’s still not maybe the case often in games, because by definition that competition’s either very high or very low depending how you approach it, yeah?

So any other game It’s by definition your competition. But on the other side if you compare it from other verticals, let’s see in retail you compare yourself. Let’s see. I’m the show up selling the TVs. Then of course, in the other shops selling the TVs, it’s much more closer to my business than if we’re talking about two different games, yeah, because there is no in, at least in the theory, two games that are the same no, reaching the same audience, there always will be some even small differences between, how you approach the user.

So that’s, from one side, you can block that sometimes in your mediation or like in the placement. Then, of course the second thing is a lot of stuff is defined by your audience as well, because then more and more of this ad spend is done by programmatic solutions.

Either that are more done that you are buying some like private inventory or you are just reserving something or you just promote some art in the solutions like Google or like Facebook, because those are like programming solutions as well. So very often your audience is defining who you will be bringing.

So for example, if you have the app. That or like the game that is mostly played by, let’s see, middle aged men. I can guarantee you that most of the ads you will get from Forex. From automotive companies from like in general, those businesses, they care really about those those groups of the users.

Yeah. Those who are in general, because again, if we look at the interest, they are very similar to each other in terms of the demographic group. Yeah. Of course, if you have, let’s see the game that is focused on the women, then, of course, on one side, you will have probably quite a lot of ads from the games that are focused on the women.

It would be like, maybe especially casual, like match three match games. Or if you have more like a lot of middle age or older women, probably you have a lot of casino ads as well, but still usually again the rich. And the placement is defining quite heavily what kind of audience and what kind of ads you, you can get.

Yeah, but again from that perspective if you have if you are a smaller developer who just starts with this ads advertising, then usually do not pay so much attention to that. Maybe. to the aspects like, okay, to which extent I can monetize that user. Yeah. So what is maybe I should put some limits.

On ads per user, per session per day, because like the more ads, then of course, the there is specific situation when you have too many ads, probably. In your Google Play or App Store page, number one no kind of review or like number one topic that will be said and shared in the reviews would be okay.

There is too many ads. Yeah. So if you have. Not enough of them, then you are not optimizing your your monetization. Yes, it’s a kind of, you need to find that balance between how to optimize, how to actually, the monetize the users, but in the way that it’s not going to. too far. Yeah. And you see some different approaches like okay, if I care a lot about this user experience, I’m focusing on the rewarded video or sometimes on the other extreme, like I saw quite a few developers that they wanted to monetize in some way like India or like the other markets that are That have very high volume, but pretty low CPMs.

But to the extent that, for example, the F frequency caps, they were adding to the apps were higher uhhuh in case of countries like India versus countries like us. Yeah. So the user in India was getting, by average, for example, more as a user in US, because again the audience in US. was reacting much more negative to the ads than, for example, the audience in India.

Roman: And you are just to switch gears you were showing us in those slides also that the ad revenue is actually growing.

Mariusz: Yes, it’s, of course it’s true. Difficult topic, but there is not much data around the and what is the size of that of that revenue. I think that there are a few approaches on the market, for example, done via Statista or via the other players who are trying to approach a little bit from other perspective.

So they were trying rather to analyze the data from the advertiser’s perspective. So they were like, analyzing, for example how much money different media houses or like different type of businesses are spending overall in apps, in games. And by, by that trying to analyze what is that, that, that market.

And we see that there’s actually market estimation for the, for that market is pretty high. So we can say that even if we look at the data that is estimating the, in the in app revenue plus subscriptions for around like 95 billion in 2024, then in, in ads, it’s even higher, a little bit higher, like no, but more than a hundred billion and actually even growing faster.

Then in app revenue, because like more or less now if you look at the general data in app revenue in games go grows around four or five percent year over year versus in in in ads it’s actually going, growing much, much faster, yeah, so there are estimates for the next years are between like, 10 to like 10 to 15 percent and then starting from around 8 percent starting in like 2026 2027.

Of course, it not necessarily means that we will have all the time growing eCPMs on the market, yeah? Because what is quite important to remember is that the concentration, the revenue is much higher in top games in app revenue than in ads. What I mean? Top 10 I’m not sure if I was sharing here.

Let me check, actually yes, I have it here. So what the data shows in this case, we have comparison of or like my estimates, let’s call it. Yeah. What are, what is the top games by revenue? If we look on the in apps so we have that graph on the left side and we see that for example like top 10 games which is like the blue part.

is taking almost 20 percent of the revenue versus look at the more kind of estimates that is done based on Optica, for example. And it’s more like a little bit from the different dimension because it’s more like ad distribution share. So more like kind of impressions. So the real data will be a bit different because it doesn’t take into consideration the ECPMs.

Because there is no way to do it now, but still for sure the top 10 games is taking much smaller part of that pie, which finally we can say that if I am more kind of established brand the competition flow and competition range will be much higher and much deeper in the in ads than in app.

Because there is if you have smaller developer, very often he will start from ads in terms of monetization rather from, than from in app, yeah? Because in app is just harder. It takes much more time, it takes much more resources, yeah? So that’s why Depending how we counted in app is more established.

So once you are there, you have a little bit more competitive advantage. In apps it’s a little bit easier to enter, which means that it’s easier for smaller developer, but on the other side means that it’s Harder to scale beyond specific size and then not necessarily even growth off the off the market in terms of the whole size.

Not necessarily will be increasing e C. P. M. S. Because the new inventor that is coming to the space actually is growing quite fast as well.

Roman: I see. But how does this align with all, like for the last couple of years I heard about like hyper casuals design, and that means like the mostly what is the source basically on this growth?

Mariusz: I think there are like different different hypothesis. But if I actually I don’t think I have it in in this slides, but maybe I can, show something which I think will be quite important.

Let me, I’m not sure if I’m able to show it. Okay but what I mean by that can you see actually my screen? Yep, but still

Roman: the same

Mariusz: concentration. Okay but what I mean, if we look at the most recent data and we can actually find it find that analysis in my latest spots at LinkedIn today, both on iOS and Android, in general, the revenue grows much faster than than downloads.

In general, it means that the gaming And actually non gaming as well, it’s growing more by the like by growing monetization rather by growing the usage per se, yeah? Which means that finally, every download over time gets more and more valuable. That’s why, by definition, industry is forced to improve the monetization per download, which means that finally even in case of hyper casual, that is of course, why the, in terms of the reach, but even in hyper casual, we see that the downloads are not growing so fast as it used to be in order to be competitive, in order to win the.

the space around the user, because again, if we have the revenue growing faster than downloads and their monetization is growing, then finally, of course, you have more like the the focus and more concentration in terms of the competition over those users as well. So finally, you have higher and higher battle about those same users.

So finally, even the hypercasual, in order to be competitive, needs to improve the monetization. And that’s why I don’t think the hypercasual died. I think the hypercasual in some way got forced. to move to the place where it can actually monetize those users better than in the past. So that’s why you see more and more actually successful hyper casual publishers trying to move at least part of the products to the place where I can whether they can increase retention after day seven, keep users longer because again You need to monetize the same download better than in the past.

So finally, you are, by that, if you are keeping users longer, then you have better opportunity even to to actually use this main magic of the free to play, where in general some users are able to pay to, for example Decrease the time they will spend to do some progression or like to do some like change in the game.

Yes. So again, I think it’s more it’s of course coming from longer from stronger monetization, but it’s more like the outcome of that download versus revenue, which I think finally it’s even coming. point that if you look at and I was showing that in in some data, let me actually show it to you as well.

There are a few reports like this one, sorry, or this one that was just shared recently by by By unity, for example, and I resource as well. And that actually it’s corresponding with the same data that is on the Google side. We see that in general there is more and more focus in the industry on high value users.

So if we look at the screen with you see that share of the just CPI campaigns when you just buy the user. It’s actually declining versus those types of campaigns where you are focusing on bringing the users that are more likely to to spend in the app or the, they’re more likely to have the higher ECPM in apps.

So finally, what it makes is that you have more and more advertisers focusing on the same set of audience, those high value audience, which finally adds again. More and more this behavior that the revenue goes faster than the than than downloads, which means that finally I think what we see is very strong connection between like monetization and user acquisition.

And it’s chick and ad chick and ad discussion, what is causing what? But for sure, there is very strong connection correlation between those two points.

Roman: Yeah, and now I also see that from the advertiser’s perspective. They use one channel often. It is just google and they start the campaigns and send the revenue They might not even have a user acquisition manager like a founder does everything himself.

Mariusz: Yeah, because it’s you know From the revenue perspective, especially from the short term approach is the most safe approach. Yeah. You just define, okay, that’s the day seven rows that I can afford or like day 14. And like the whole campaign is just to optimize towards the users who actually can.

achieve that threshold, which finally gain you have more and more advertisers pushing for very similar group of users, which final is a little bit leaving alone the the rest of those users who at least based on those metrics are not so valuable for the business.

Roman: Yeah, let’s also look as one of the last questions, the genres.

I really like your graph on the genres that are growing.

Mariusz: Yes, of course it’s it’s broad topic, but if you look at there’s a bit different situation on the on the iOS side. Like in this case, we see that overall in iOS, we see quite important growth of the monetization on the.

Core gaming. So like we see, for example, Forex Strategy, MOBA, and in this case, we have the graph that is comparing year over year growth rate for downloads versus revenue. Downloads is more like horizontal like revenue is the vertical. And then, of course, size of the bubble is the How big is that vertical by revenue now?

Yeah, so we see that in this case the verticals like mobile like forex strategy they’re really big and still still growing. What is happening as well that Some smaller genres that are not growing so fast this customization runners so merch, of course, is growing quite heavily as well.

And some interactive games, other idle RPG. So those that in general I think those genres that are finding good ways. To combine the strong monetization with pretty good entry for more casual users. And everyone is talking about those games the no White House Survival or those no, play the games those that in general are combining pretty deep gameplay with pretty no good opening for the wider users.

In case of Android we see that actually that growth is overall lower than in case of iOS. But that’s, that I think is the fact that in general in the last months the iOS is growing a little bit faster than Android. So that’s why we see that the structure Of those growing genres is quite similar.

It’s just a few points a little bit down versus the iOS. Yeah, so we have still strong results, for example, for for Forex strategy for MMO puzzle RPG. So we see that actually there are. Quite similar in terms of which genres are growing, which genres are declining, just again, a few percentage points below the the iOS.

Roman: Awesome, awesome. And all of those, unfortunately, really takes a lot of time to develop, all of those core games strategies, this is for big guys.

Mariusz: Yeah. So that’s, I think that exactly is the case. I think finally, whoever is defining what he needs to do, he needs to think a little bit about, again this data.

Yeah. It’s by definition, gaming is high win, high risk. And what it means is that if we compare this in app versus ads, that in app is more like, or like even deeper core audience that is, very expensive to get, very expensive to read, but then finally has Very high monetization versus that is that, that, that is very casual.

That is very like, very easy to get. And a lot of that user audience can come even from emerging markets. That’s fi finally. It’s that that, that trade off. Yes. Everyone is talking about monopoly go game. But that game was based on discussion, it seems to be, it was developed by seven years.

Yeah. So in this case versus if you have simple ad based game, you can create it like in even in a few weeks. Yeah. So I think it’s more discussion where you can which type of genre type of the game you can afford, because it’s easier to say. It’s easier said than done, for example to get the financing for five or four or seven years of doing the game, even the good one.

Yeah. So I think is that is the case what you want to achieve. You want to survive and you have small teams. So in this case, better to focus on those maybe niche games, those that are more that have wider audience or you can really focus on those core genres, but let’s see in 4x or in like role playing the high value user in us can cost 50, 60 for example.

Yeah. So that’s the trade off that you need to make. Yeah.

Roman: God admires. Thanks a lot for all the data, for all the graphs. This is like great. I’m sure the viewers will like it. Pause on a lot of this stuff, even when you’re scrolling, they will pause to see what else was there. So this is like very helpful.

I got a last thing for you. One prediction for 2025.

Mariusz: Oh, one. I think it’s going to be good year. In the way if you look at the data in general, the data is improving, maybe not very substantial, not extremely fast, but in general, it’s improving. That’s one. Maybe I would add three instead of one because that one is more like a general.

The second one, I think that monetization, they will speed up because again, the Even if the market is growing, then the competition will be growing as well, especially that as we have more and more tools that can add some elements based on the eye, based on some specific processes store assets and so on.

The number of content will not be going down. It will be going up quite heavily, which means that finally, as the company, either small or big, you will have more. Neat and more forced to really try to find some niche in this or like some new incremental revenue by maybe hybrid monetization, but maybe by some private agreement with the specific brands, maybe by trying to change the way you do user acquisition, but that’s, I think will be like much way, way more innovation than in the than the this year, especially in 2023.

Three. Because if we look at the perspective as the industry grows, then there is a little bit more eagerness to try out new stuff. Yeah. Because again, for me, 2020, 2023 was way more like year of survival. Then you could see that in 2024, those budgets started to grow because you had more and more companies that were eager to test new stuff because they had no some permission from the top to do it, either looking for new growth opportunity or by improve the profitability that happened in 2022, 2023.

And then I think a third point if you look at the data, 2023 and begging of 2024 was the moment where a lot of growth was coming, especially from U. S. And from those Western markets. And I think that is in some way, I will not say going to the end. But if you look at the event data deeper around the How the people in those markets are perceiving the current economical situation how they they look at their the financial situation, we see that actually the emerging markets they look like much better in the data and then Western markets.

Yes. So I would expect the changes in this consumer behavior happening better. And I would say more positive on the emerging markets than in case of tier one markets.

Mariusz: I don’t think it’s only positive because we see that even in those reports that there are not only pluses, there are some minuses as well.

So it’s just, I think the the case is which perspective you want to look at either this, okay. The competition is growing extremely strong or okay. The growth used to be 25%. Now it’s more like 5%. So that’s a bit different position we had in the past, but on the other side, if you compare that I did the comparison which seems that, for example, like the gaming market, if you add the iOS and the.

Sorry, if you add the in app versus in apps if it’s actually a bigger market than all podcasts and cinema taken together, it’s huge business and huge market. Yeah. Which means that there is still a lot of opportunities for the growth. You need just to find them and it just not so easy as it used to be.